About

India is among the fastest-growing fintech ecosystems in the world, driven by a sharp rise in digital adoption in recent years. The country’s fintech market, which surpassed $793 Bn in 2024, is poised to cross the $2.1 Tn mark by 2030.

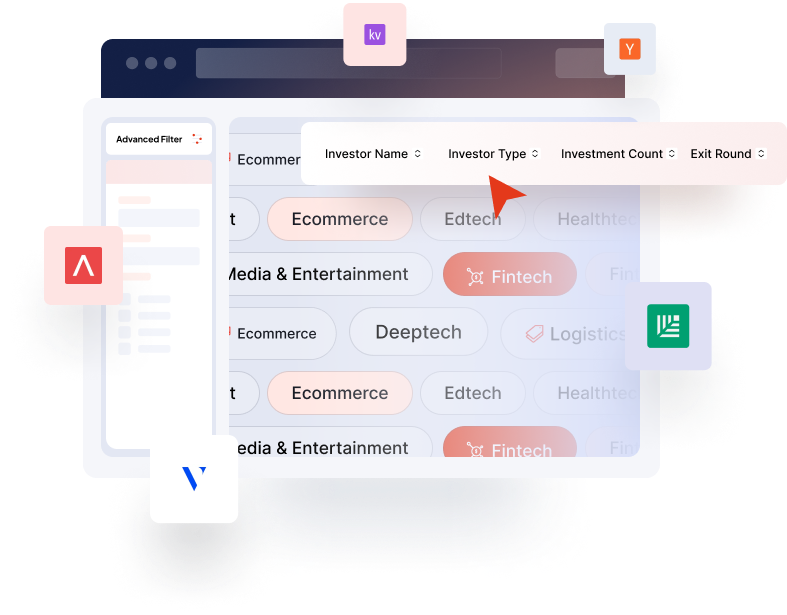

In India, the fintech offerings range from digital payments, neobanking, and insurance to lending and investments. The biggest contributor to the fledgling ecosystem has been the lending tech sub-sector, with its total market size breaching $402 Bn in 2024.

The sector fostered about 25 startup unicorns. Notable startups in the sector include PhonePe, Pine Labs, CRED, BharatPe, PolicyBazaar, Zerodha, Grow, and Razorpay, among others.

According to data compiled by Inc42, the Indian fintech space has raised more than $12 Bn between 2014 and 2024. The deal count during this period has stood at 603+, making it the second most funded space in the Indian startup ecosystem both in terms of deal count and amount.

Recent Stories

FAQs on Fintech

What is the total funding raised by startups in Fintech sector?

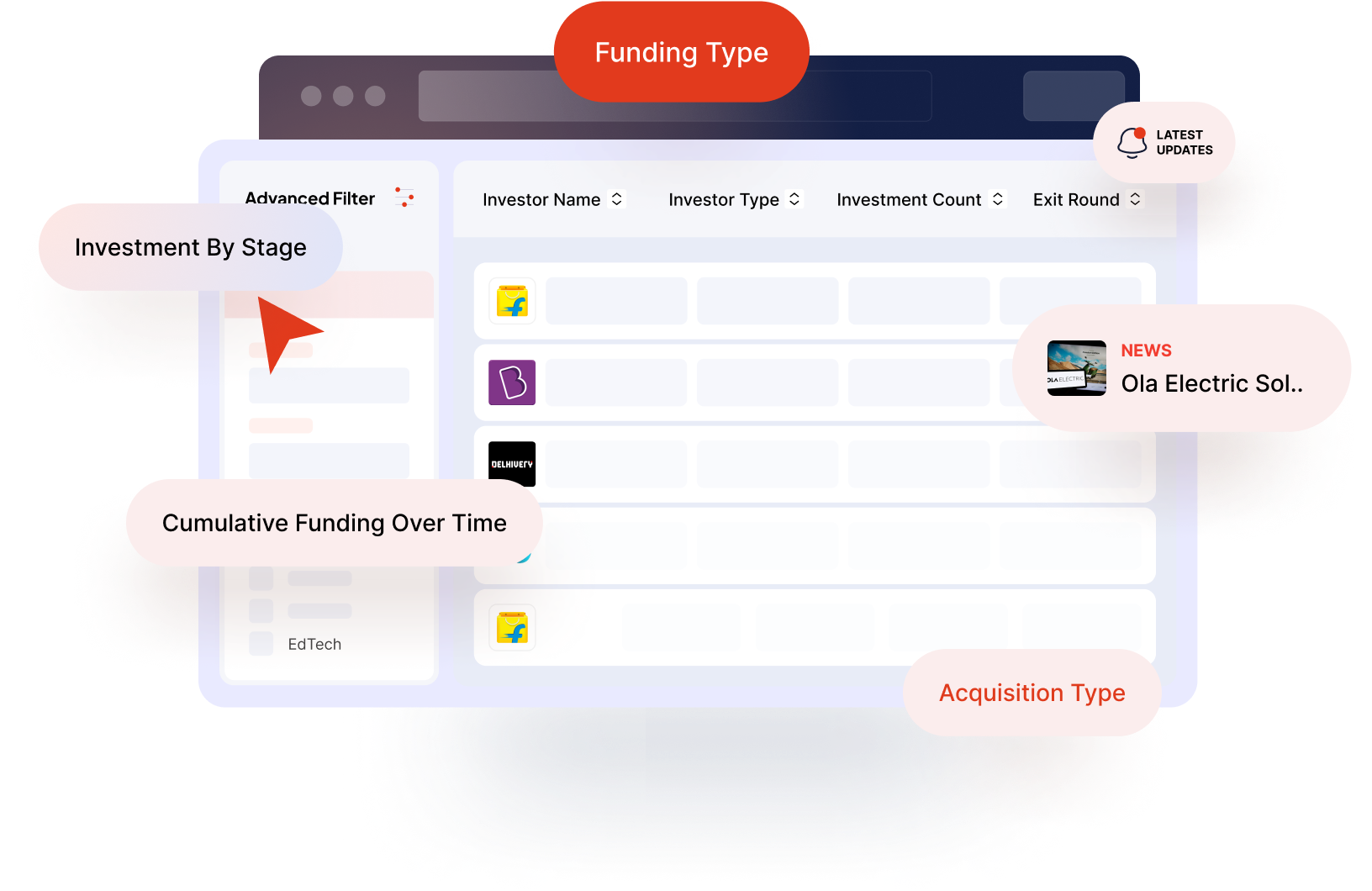

Companies in the Fintech sector have collectively raised a total funding amount of $136.64 billion across 3668 funding rounds.

Which funding round is most common in the Fintech sector?

The Late Stage is the most frequent funding stage for companies in the Fintech sector, with the majority of deals occurring at this stage.

Which location dominates funding in the Fintech sector?

Noida is the top location for funding activity in the Fintech sector, attracting significant investor interest.

What is the total acquisition amount in the Fintech sector?

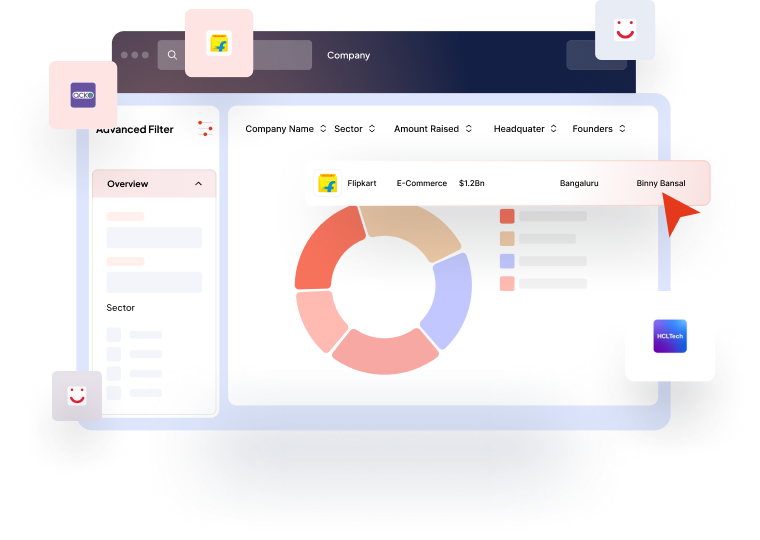

Companies in the Fintech sector have seen acquisitions worth a total of $4.4 Bn, with Flipkart being the top acquirer and FreeCharge being the most notable acquisition.